By Compounding Academy

Welcome to the second edition in the mini series of What Makes A Quality Business. In this issue, we explore how competitive advantage powers long-term compounding. From pricing power to brand strength, we break down what makes a business resilient — and hard to compete with.

When we invest, we prioritize companies that are #1 or #2 in their industry. Why? Because over time, market leaders tend to widen the gap versus their peers — benefitting from scale, pricing power, customer loyalty, and the ability to reinvest for growth. Here are a few examples of the competitive advantages we seek:

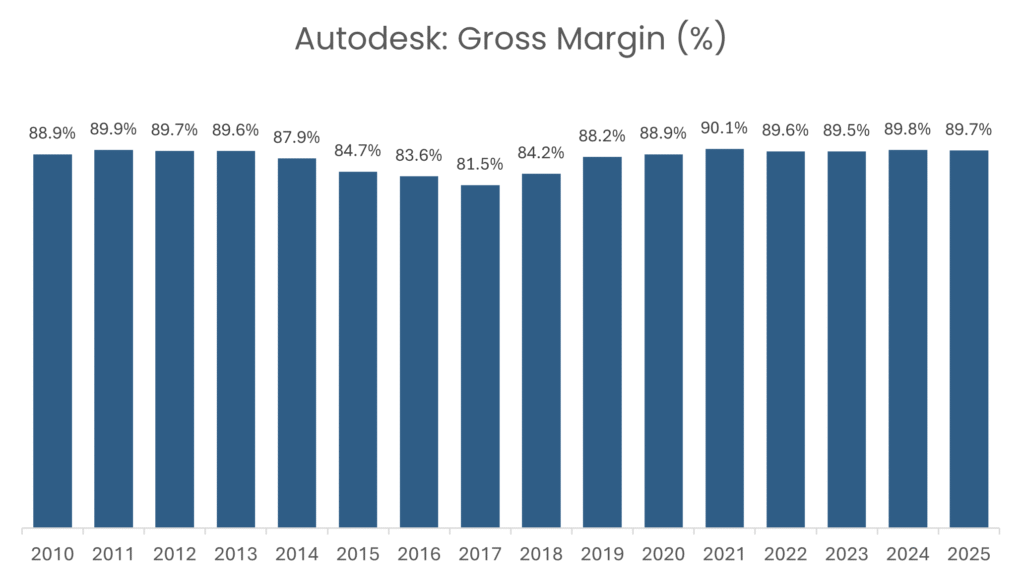

Autodesk is a great example. Its industry-standard design software is mission-critical — projects often can’t be completed without it, giving Autodesk strong pricing power. Gross margins dipped between 2015 and 2017 as the company transitioned from one-off license sales to a recurring subscription model. While this temporarily reduced margins, it ultimately strengthened Autodesk’s competitive position, locking in customers. Today, its consistently high gross margins are a clear sign of durable pricing power.

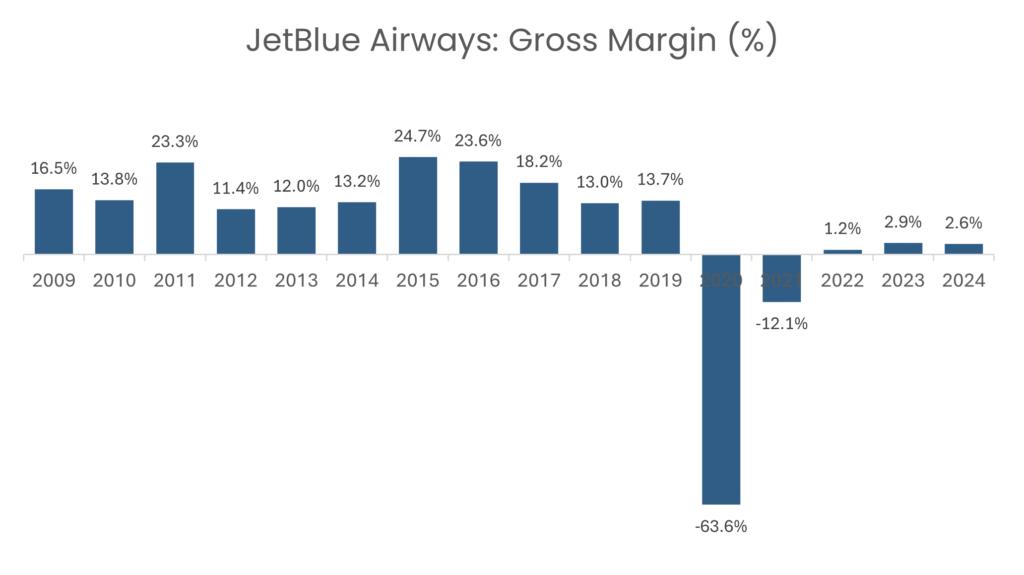

On the other hand, JetBlue Airways’ lack of pricing power stems from intense competition from other airlines, plus consumer price sensitivity, fluctuating operational costs, and regulatory constraints, forcing it to keep prices competitive to retain customers. This is evident from the highly volatile gross margins.

We avoid companies in brutally competitive industries!

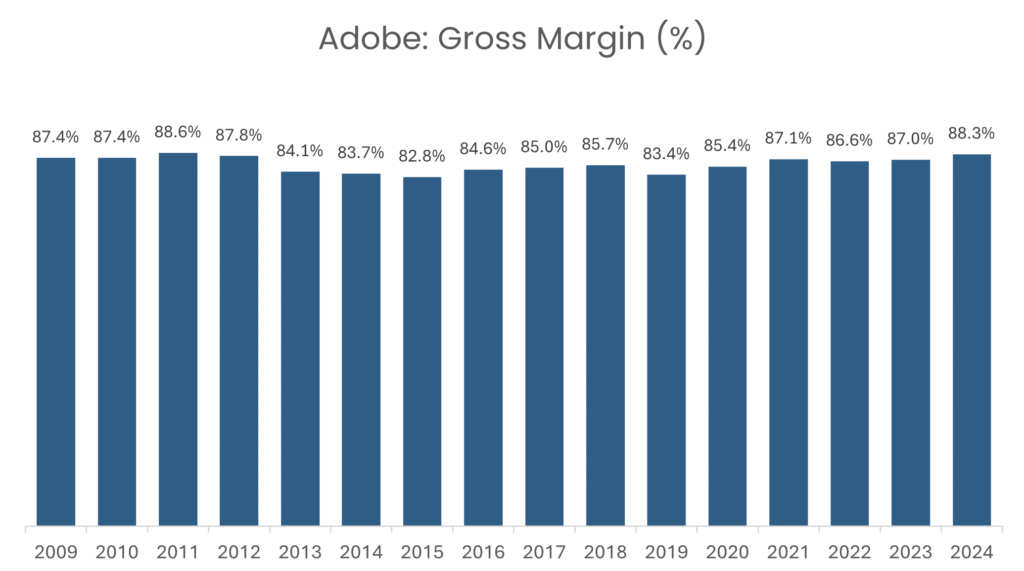

Companies with strong, innovative technology often face limited competition. Adobe holds a dominant position due to its mission-critical software suite for creative professionals — resulting in sticky, recurring revenue.

Its $3.6bn R&D spend (18% of sales) fuels innovation, reinforcing its competitive edge and making it hard for new entrants to compete.

40 years of innovation has built an unrivalled creative ecosystem that’s deeply embedded in client workflows.

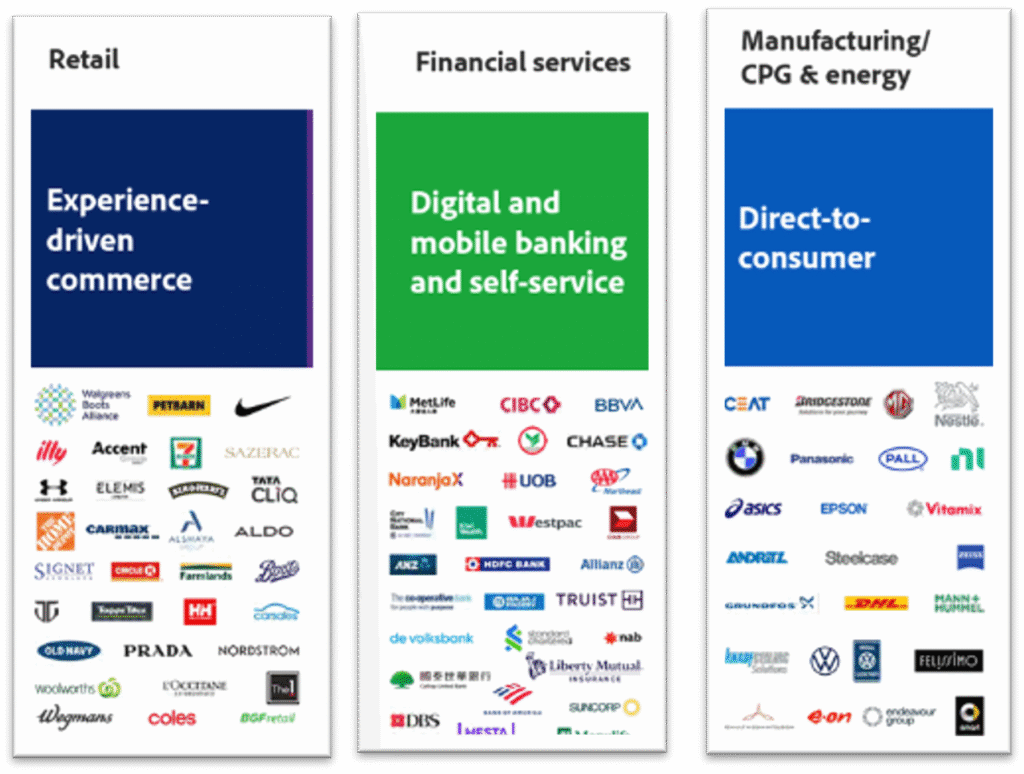

Adobe’s platform also powers customer experience management across industries — from digital banking to retail and healthcare. These solutions are mission-critical, making Adobe deeply embedded in client workflows and hard to displace.

Here are just three of the many industries where Adobe’s solutions are deeply embedded — underscoring their cross-sector relevance and staying power.

Its scale, high renewal rates, and low incremental costs result in exceptionally stable and high gross margins:

Even with the rise of generative AI, Adobe’s dominance looks resilient — its ecosystem is deeply embedded in the workflows of creative professionals.

Strong brand recognition and customer loyalty create powerful competitive moats.

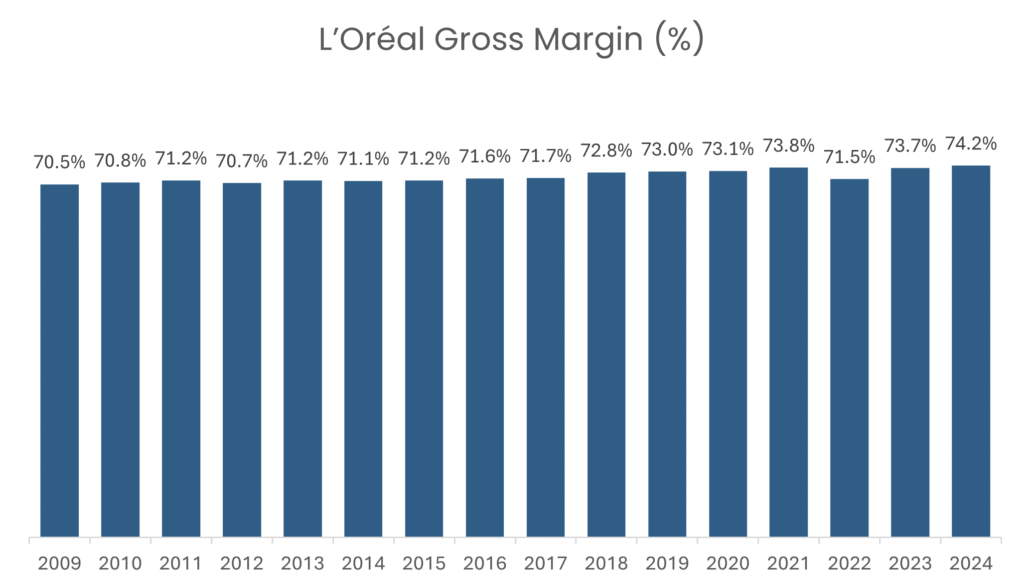

L’Oréal’s competitive edge stems from its robust brand equity, supported by a diverse and trusted portfolio of beauty and skincare products, plus a longstanding commitment to innovation. This brand strength fosters deep customer loyalty, enabling consistent demand across global markets.

L’Oréal’s global brand recognition helps it sustain gross margins above 70% across diverse market segments — a clear sign of pricing power and product stickiness.

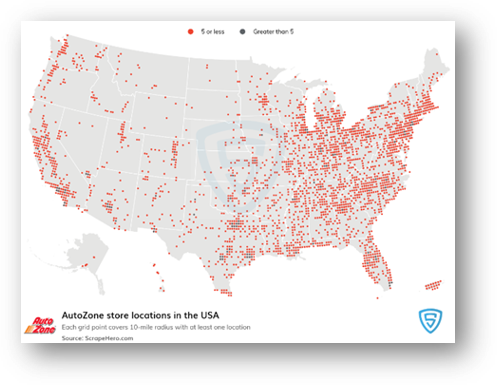

Scale is a powerful competitive advantage. It takes years — often decades — of investment and learning to build, making it difficult for new entrants to challenge established players.

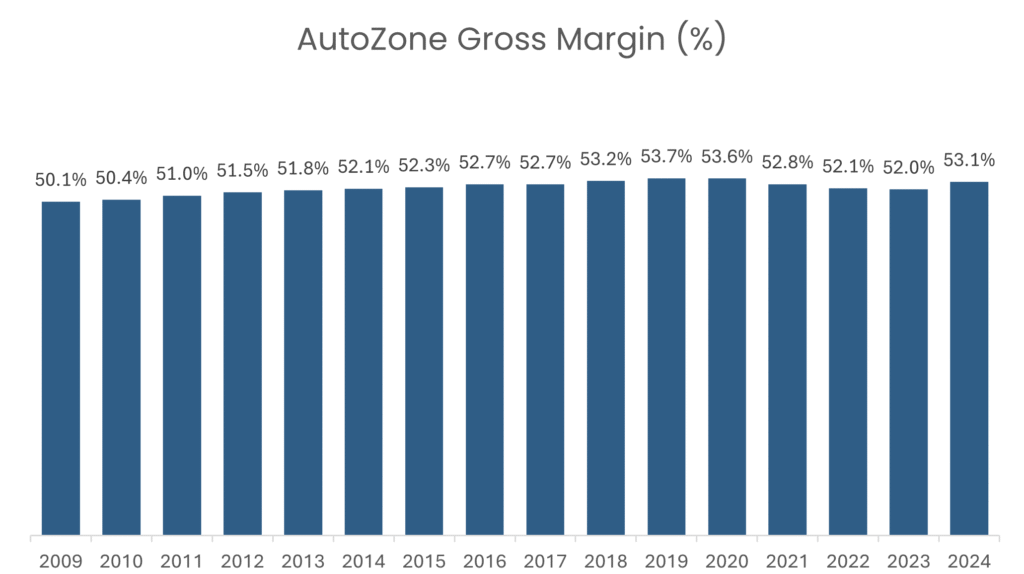

Take AutoZone, which has over 6,700 stores across the U.S. This national footprint provides competitive advantages like vast inventory, superior logistics, and significant purchasing power.

Combined with high-margin private label products and strong customer service, AutoZone’s scale helps solidify its market dominance and supports consistently high and stable gross margins.

Now that we’ve explored the power of competitive advantage, why not put it into action? Pick a few stocks you are interested in and check their gross margins — are they high and stable over time?

Ask yourself: Does the chart show consistency like the examples above? If yes, that’s a good sign. If it’s volatile or declining, it could be a red flag.

To go deeper, visit www.compounding-academy.com to access one-pagers and real examples of companies with strong, enduring advantages.

In our next Newsletter we’ll explore Competitive Moats — another super-important characteristic of any great business. See you next time!