By Compounding Academy

This is the next issue in our What Makes a Quality Business miniseries. Today we turn to one of the most vital — and misunderstood —characteristics: Competitive Moats.

Moats are the invisible walls that protect great businesses from competition. Without them, even the best products or services get commoditized. With them, businesses can defend margins, reinvest confidently, and compound value for decades.

A competitive advantage helps a company win. A moat helps it keep winning.

Moats are enduring, structural barriers to entry — the kind that allow a business to stay ahead even as competitors try to catch up. The best moats often strengthen over time.

Common types include:

If a business lacks a moat, high returns tend to attract competitors — and profit margins eventually erode.

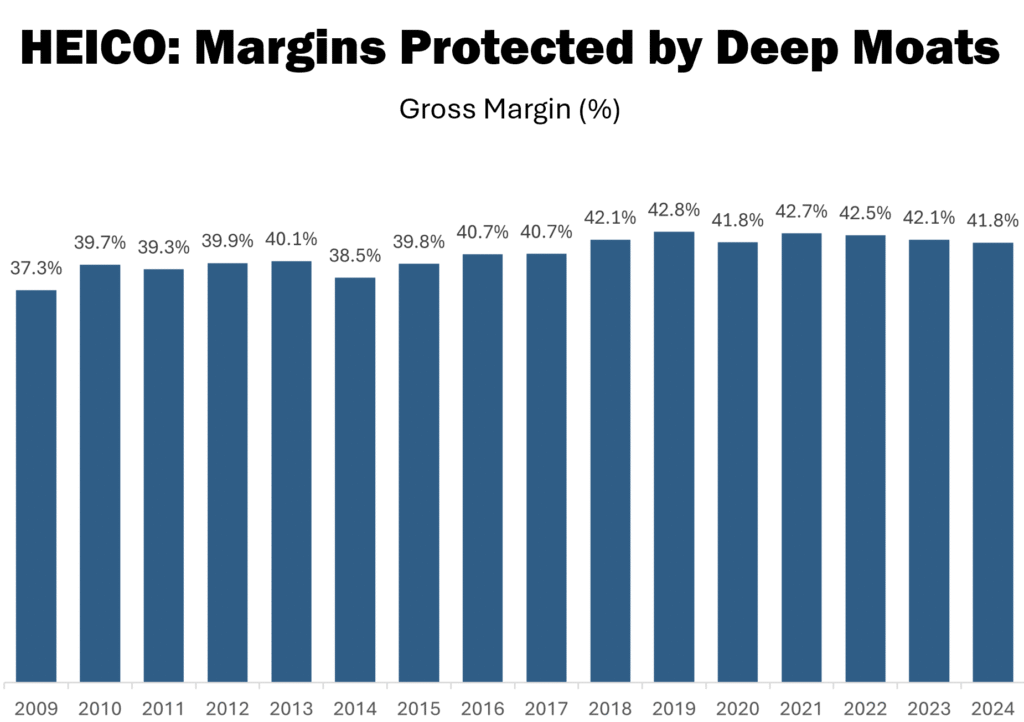

HEICO quietly dominates a niche market: FAA-approved aircraft replacement parts.

Its regulatory moat is simple but powerful. Every part must go through years of certification. That alone deters new entrants. But HEICO’s edge goes deeper: it works closely with airlines to co-develop certified parts that are cheaper than those from original equipment manufacturers (OEMs).

The result?

Margins have remained robust through numerous economic challenges — a clear sign the moat is doing its job.

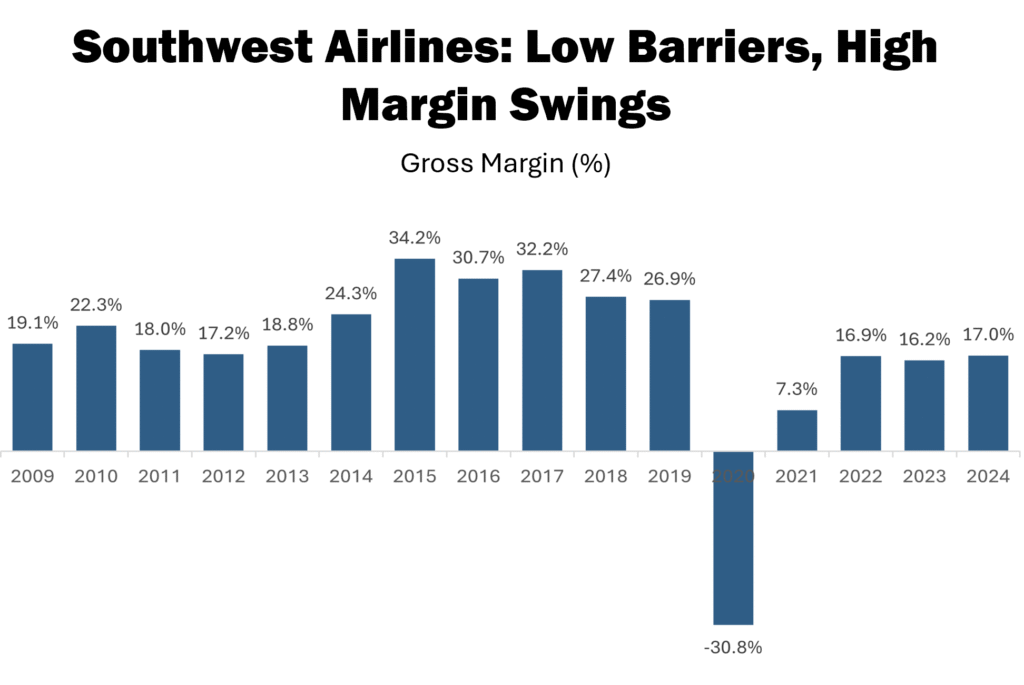

While HEICO thrives behind regulatory walls, Southwest Airlines is a well-run business but operates in one of the least protected environments imaginable.

Airlines face intense competition, commoditized services, price-sensitive customers, and external cost volatility (fuel, labor, etc.). As the chart below shows, Southwest’s gross margins swing wildly — even going negative in downturns.

There’s no moat. Just a constant battle to survive.

That’s the power of a durable competitive barrier: HEICO’s profits are protected. Southwest’s are exposed.

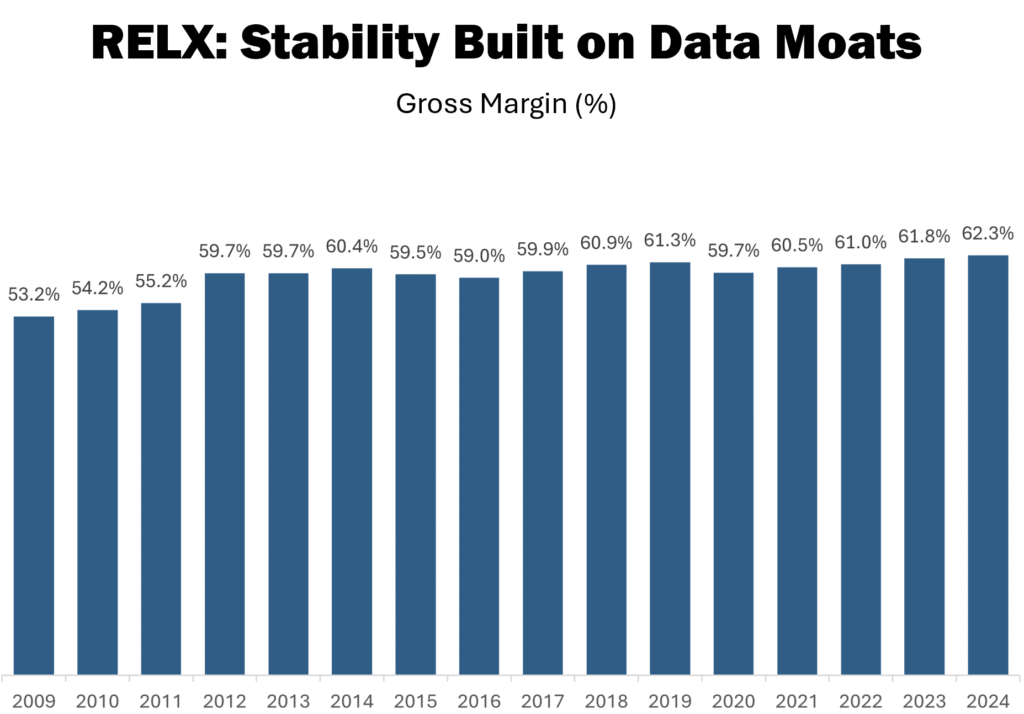

RELX operates in legal, scientific, and risk analytics — industries that run on information. Its moat? A blend of proprietary content and workflow lock-in.

Through decades of aggregation, RELX owns exclusive data sets and journals. Legal professionals rely on LexisNexis. Scientists can’t do without Elsevier. And once embedded in daily workflows, customers don’t switch — even if a cheaper option appears.

This results in:

It’s institutional dependency. And it’s a moat that widens with time.

Real moats don’t rely on hype or momentum. They show up in the numbers:

Watch out: a first-mover advantage isn’t a moat. Nor is a viral product or a “great story.” If the edge can be copied easily, it won’t hold up.

Take 3 companies on your watchlist. Ask:

These questions will help you cut through noise — and focus on quality that lasts.

To see how companies like HEICO and RELX demonstrate moat strength — and how it factors into our quality scoring, visit www.compounding-academy.com.

Next up in the series: We’ll cover Capital Allocation & Asset Light Business Models — why these traits are as critical as a strong moat.